Making the Most of a Roth IRA

June 17th, 2025

3 min read

Retirement & Longevity Planning with GDS Wealth Management

At GDS Wealth Management, we believe that thoughtful planning today can help support financial confidence tomorrow. One powerful tool in your retirement strategy may be the Roth IRA. Let’s explore how this account works, who it benefits, and how it can support your long-term goals.

Why Consider a Roth IRA?

A Roth IRA allows you to contribute after-tax dollars today in exchange for tax-free withdrawals in retirement. That means your money grows tax-free—and when you’re ready to enjoy it, you won’t owe taxes on qualified distributions. This can be especially advantageous if you expect to be in a higher tax bracket in retirement.

Here are a few standout benefits:

- Tax-Free Growth & Withdrawals: Once you reach age 59½ and have held the account for at least five years, all withdrawals—including earnings—are tax-free.

- No Required Minimum Distributions (RMDs): Unlike traditional IRAs, Roth IRAs don’t require you to withdraw funds at a certain age, giving you more control over your retirement income.

- Contribute at Any Age: As long as you have earned income, you can continue contributing—no age restrictions apply.

- First-Time Homebuyer Advantage: You can withdraw up to $10,000 (lifetime limit) penalty-free to help with a first-time home purchase.

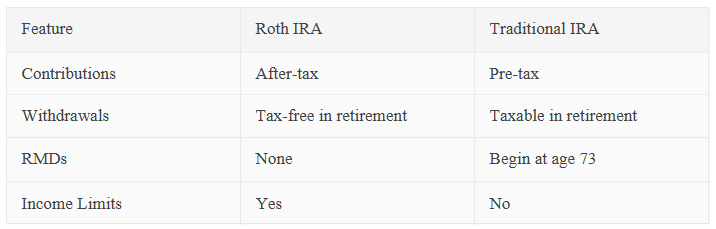

Roth vs. Traditional IRA: A Quick Comparison

Know Your Contribution Limits

For 2024, the annual contribution limit is $7,000—or $8,000 if you’re age 50 or older. However, income limits apply:

- Single/Head of Household: Full contribution allowed if your Modified Adjusted Gross Income (MAGI) is under $146,000. Phases out between $146,000–$161,000.

- Married Filing Jointly: Full contribution allowed if MAGI is under $230,000. Phases out between $230,000–$240,000.

- Married Filing Separately: If you lived with your spouse at any time during the year, contributions are limited unless MAGI is under $10,000.

These figures are subject to annual IRS updates.

Let’s Talk Strategy

Whether you’re just starting your retirement journey or fine-tuning your legacy plan, a Roth IRA can be a valuable part of your financial picture. At GDS Wealth Management, we’re here to help you evaluate your options and make confident, informed decisions. For more information on Roth IRAs and Roth conversions, check out the GDS Unplugged podcast episode on “Mastering Roth Conversions”.

Glen D. Smith, CFP®, CRPC®

Chief Executive Officer | Chief Investment Officer | Founder

469.212.8072 | www.gdswealth.com | 2910 Lakeside Village Blvd. Flower Mound, Texas 75022

GDS Wealth Management (“GDS”) is an SEC registered investment adviser located in Flower Mound, Texas. Registration as an investment adviser does not imply a certain level of skill or training. GDS does not provide tax or legal advice. You should contact your tax advisor, accountant and/or attorney before making any decisions with tax or legal implications. All information is provided solely for convenience purposes, and you should be guided accordingly.

This blog contains general information that is not suitable for everyone and was prepared for informational purposes only. Nothing contained herein should be construed as a solicitation to buy or sell any security or as an offer to provide investment advice. GDS Wealth Management (“GDS”) is a registered investment adviser. For additional information about GDS, including its services and fees, send for the firm’s disclosure brochure using the contact information contained herein or visit advisorinfo.sec.gov. The information contained herein is based upon certain assumptions, theories, and principles that do not completely or accurately reflect any one client's situation or a whole exposition of the topic. All opinions or views reflect the judgment of the authors as of the publication date and are subject to change without notice. This communication contains certain forward-looking statements that indicate future possibilities. Due to known and unknown risks, other uncertainties, and factors, actual results may differ materially. As such, there is no guarantee that any views and opinions expressed herein will come to pass.

Your financial advisor can answer any questions you may have about the features and benefits of IRAs and help determine which type may be appropriate for addressing your retirement needs.

Please note that tax laws are subject to change and may impact your situation. While we are familiar with the tax considerations discussed, GDS Wealth Management and Raymond James are not qualified to render advice on tax or legal matters. You should discuss any tax or legal matters with the appropriate professional. This material was created by Raymond James for use by its advisers.